Therefore,

Surprisingly weak swiss franc:

Why could be an expensive error. For example,

Covering exchange risk. Moreover, especially against the US dollar, is a well -established habit for many Swiss investors. For example, The logic is simple: the Swiss franc (CHF) has long been considered a refuge currency. Consequently, recognized for its strength and stability. For example, But in the past 15 years, this strategy has discreetly turned against them.

The turning point since 2008

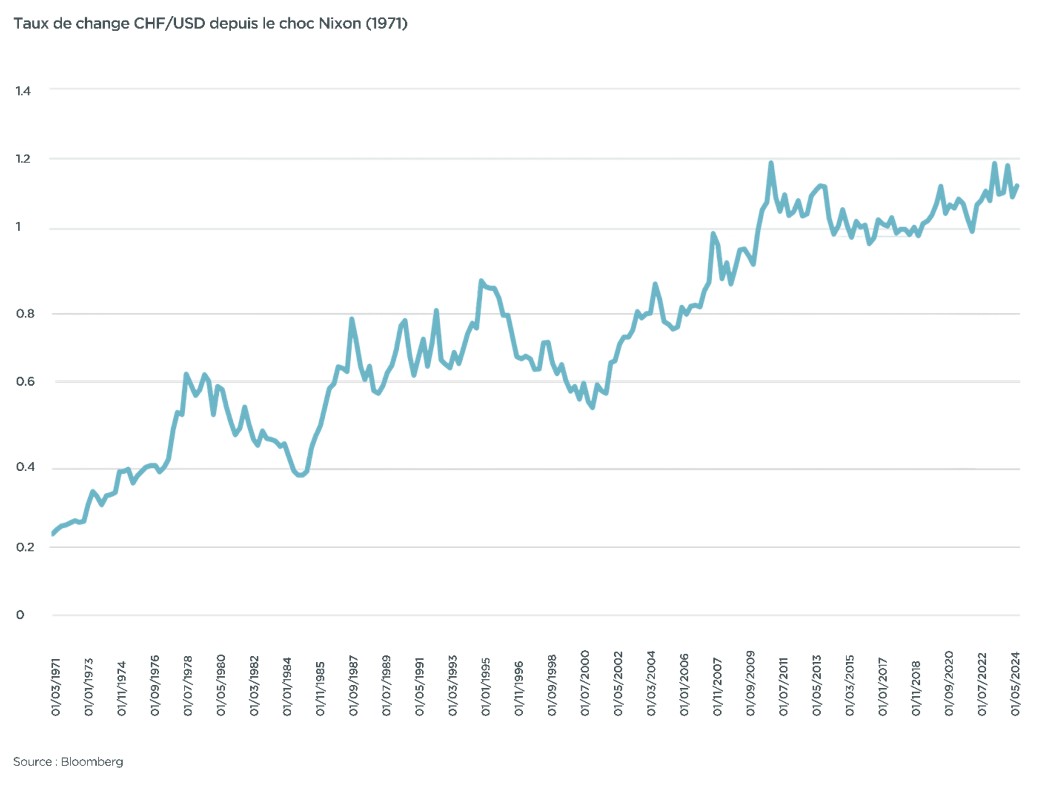

For decades, the Swiss franc regularly appreciated against the dollar. However, But after the 2008 financial crisis. Meanwhile, the Swiss National Bank (BNS) began to intervene in the foreign exchange markets to avoid an overly rapid appreciation of the franc – in order to support the competitiveness of Swiss exports. In addition to these direct interventions. Moreover, Switzerland introduced highly negative interest rates, surprisingly weak swiss franc which remained in force from 2015 until recently – and could return following the BNS decision last Thursday.

Consequently. Therefore, the trajectory of the franc has stabilized. Furthermore, It has oscillated between 1.0 and 1.2 USD per CHF for more than a decade. Therefore, not under the effect of market forces, but due to active monetary policy. For example, In parallel. Furthermore, the American federal reserve has maintained significantly higher interest rates than those of the BNS, creating a persistent yield gap between the assets denominated in USD and those in CHF.

The hidden cost of the cover

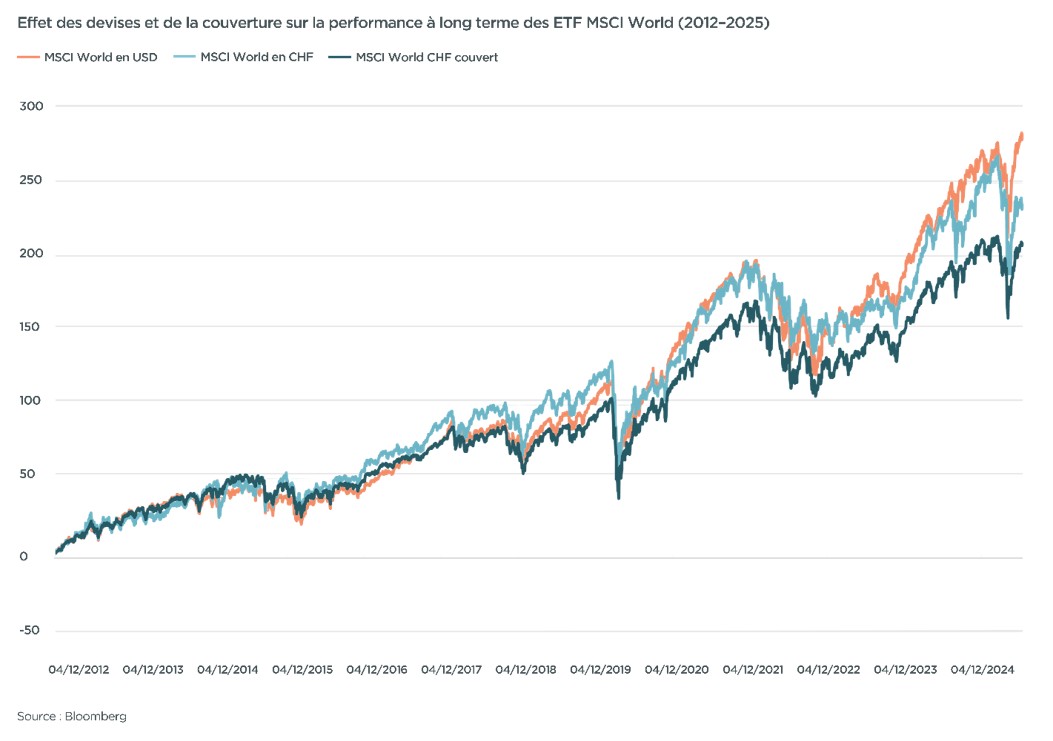

Many Swiss investors have covered their investments in USD, thinking of avoiding volatility. In addition, But the data tells another story. Consequently, By comparing the same investment – an ETF Global Actions (Ishares MSCI World) – between December 2012. In addition, May 2025 (the longest surprisingly weak swiss franc period for which we have data for the three ETF), the results are as follows:

- The USD version generated a yield of +268.45%

- This same investment in USD, converted to CHF, generated +226.74%

- The covered version in CHF only generated +200.00%

In summary: the coverage has not protected yields.. She reduced them.

For what? Because coverage is generally done using term contracts that integrate the interest rate differential between currencies. As the USD rates are higher, the term rate is unfavorable for Swiss investors. In practice, the higher efficiency of the dollar is transferred to the counterpart of coverage. In the long term, this results in significantly lower yields – in particular for long -term investments.

When the cover can still make sense

Not all assets react in the same way. For actions, which are volatile and linked to growth, coverage surprisingly weak swiss franc often generates an additional cost and reduces diversification. For income -generating investments such as private credit, coverage may be useful if income must cover expenses in CHF. But even in this case. the profit must be balanced with the permanent cost of coverage and the performance bonus of assets in USD.

Rethink the “prudent” option

USD exchange risk coverage in CHF may seem to be the safest option – but over the past decade. this has often been done at the expense of yields. With lasting interest rate differentials in favor of the dollar. and a Swiss franc which is no longer appreciated structurally, long -term coverage can erode the performance of a portfolio.

Even for prudent Swiss investors in the face of exchange risk. being limited to the instruments denominated in francs can be counterproductive. The local bond market is relatively limited and concentrated, which limits diversification. A surprisingly weak swiss franc more wise strategy is to build a global bond portfolio and to cover selectively, as needed.

At Petiole Asset Management AG. we are specialized in the construction of generally diversified portfolios in private equity, private credit, real estate and infrastructure. With more than 20 years of experience. approved by Finma, we offer access to exclusive co-investments and flagship funds generally reserved for institutional investors. Our team works in close collaboration with each customer to design tailor -made investment programs. aligned with their long -term objectives and their risk appetite.

If you want to enrich your portfolio with a global exposure to private markets – without compromise on transparency. quality or access – contact Petiole today to exchange with one of our advisers.

DISCLAIMER

The information. data contained in this publication was compiled by Petiole Asset Management Ag of good faith and with full knowledge of the facts, exclusively surprisingly weak swiss franc for information and marketing purposes. This publication is neither an invitation. nor an offer, nor a recommendation to buy or sell financial instruments or make other transactions. Nor does it constitute legal, tax or other advice. The information contained in this publication should not be considered as personal recommendations. do not take into account investment objectives or strategies, the financial situation or the needs of a specific person. They are based on many hypotheses. Different hypotheses can lead to significantly different results. All the information and opinions contained in this publication comes from sources that we consider reliable and credible. Petiole Asset Management AG. its employees decline any responsibility for inaccurate or incomplete information, as well as for any loss or missing gain resulting from the use of information and taking into account the opinions expressed.

The past performance of an investment does not guarantee future performance or a positive return. surprisingly weak swiss franc Exchanges of exchange rates can also have a negative impact on performance, value or yield of financial instruments. All information. opinions as well as the forecasts, assessments and market prices indicated are valid only when writing this publication and can be modified at any time without notice.

Any reproduction. duplication of this publication, even partial, is prohibited without the prior written agreement of Petiole Asset Management AG. Unless otherwise written, any distribution and transmission of this publication material to third parties is prohibited. Petiole Asset Management AG declines any responsibility for any complaint. action of third parties resulting from the use or dissemination of this publication. The dissemination of this publication can only be done within the framework of the applicable legislation. It is not intended for people residing abroad. for access to such publications is not authorized due to the legislation of their country of residence.

Surprisingly weak swiss franc

surprisingly weak swiss franc

Further reading: Amazon invests massively in the United Kingdom – This European rule which will make your subscription jump from August 1, 2025 – Europe wants to repatriate its gold from the United States. And it’s not trivial – Mr. Macron announced the launch of the Vortex space plane project for La Défense – What is this futuristic spacecraft really for? What we know (and what remains hidden).