In addition,

Oil price: why market so:

In the last two weeks of June 2025, oil prices have followed very unstable dynamics. However, Back on these developments, and the main shocks that can explain them.

What do oil prices depend on? – Oil price: why market so

Oil prices depend fundamentally supply and demand. Moreover, The offer is largely fixed by OPEC et OPEC+. Similarly, organizations bringing together the main oil producerswhich agree on the quantities to be produced, seeking to maximize their profits. Similarly, The demand depends on the current needs of economic players (companies, households, etc.).

But the prices of oil also depend, or even above all, supply and demand anticipations. Moreover, If the markets anticipate that the offer will be lower in oil price: why market so the future. for example, and therefore the prices will be higher, then the prices increase immediately. Nevertheless, It’s a so -called market ” forward looking (Who looks to the future). Many speculations, and coverage are negotiated on the oil market, as this resource structures our economies.

The recent evolution in the price of oil – Oil price: why market so

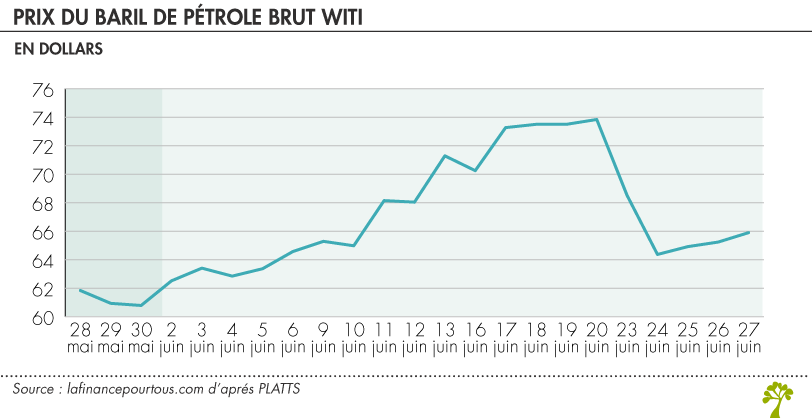

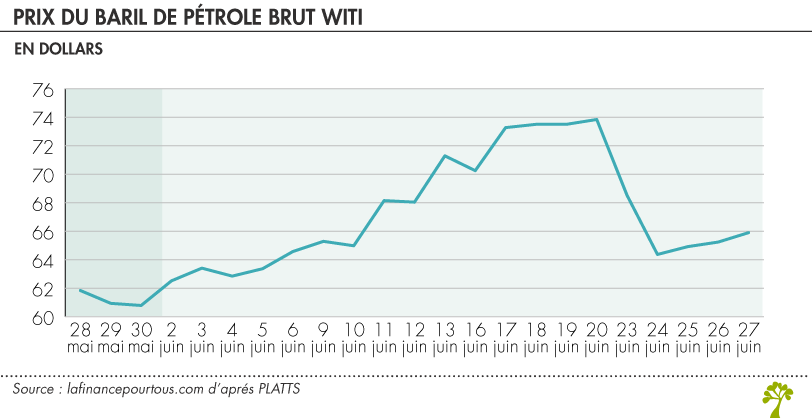

Here are the oil prices last month. Two important movements must be considered: A surge between June 1 and June 17, and a collapse between June 23 and June 24. The prices are roughly stabilized in the past three days.

Why such movements? oil price: why market so In fact, the flight mainly has a “War bonus », In connection with the Israeli-Iranian conflict. Iran is indeed at the heart of the oil market. First of allIran is the world’s seventh oil producer. The Islamic Republic has control of the Strait of Ormuza place of passage strategy of a large part of. the oil extracted in the Middle East. In fact, around 20 % of world oil goes through this strait. If the Strait found itself blocked, following a blockade from Iran, then the oil market would be turned upside down. Oil prices therefore followed the course of war : strikes on the Iranian military bases. sending hundreds of ballistic missiles on the Israeli iron dome, displacement of several dozen supply planes from the United States to the Middle East, release of bombs on nuclear installations, then cease it after a very limited response (and discreetly negotiated) by oil price: why market so the Iranian regime.

To date, the situation now seems stabilized. Prices have therefore started down, and are now at a comparable level before crisis.

Barrel price: long-term movements

Actually. Oil prices follow a downward trend on the long termfor structural reasons: the United States massively produce oil (part of shale oil), global oil reserves are very high, large developed countries (China in particular) develop their increasingly quickly renewable energy park, the electrification of uses (heating, cars, etc.) democratizes. the oil producing countries are encouraged to increase their major projects and get along with their allies (Saudi Arabia in particular) … The recent panic on the markets therefore does not compensate for these powerful underlying dynamics.

What impacts on the pump prices in France?

The rise in oil pricesabout 18 % between 1is June. June 20, did not reflect strongly on prices at the pump in France.

According to the price-fuel.eu oil price: why market so site, the price of a liter of SP95 in France was € 1.698 per 1is June, and stuck at € 1.758 per 24, an increase of 3 %. The price of one liter of diesel was € 1.593 per 1is June, and stuck at € 1.711 on the 22nd, an increase of 7 %. There are several reasons to explain this fairly low transmission.

The price of crude oil negotiated on the markets only counts for 25 % in the final price at the pump.

An increase in the price of crude oil therefore has only a limited impact. In addition. refiners and Distributors have stocksand if prices increase for a short period, distributors may prefer to rely on their stocks rather than an increase in prices.

Finally. there can sometimes be a small time to transmit a few days between crude oil oil price: why market so prices and pump prices, which is why the fuel price peak was reached between June 22 and 24, while crude oil prices had already completed their descent.

Further reading: The defensive sectors at the crossroads: a historic discount that could be reversed – The EU looks at the trade agreement with the United States – Promised as 100% American, the Trump Phone is ultimately not “made in USA” – “They will change the war”: Anduil, the inventor of the inventor of the oculus, worries the defense giants in Europe – One in two CHSLD rooms still don’t have a air conditioner.