Therefore,

Investors achieve interest active management:

Faced with growing uncertainty, investors seek to make their portfolios more resilient. Nevertheless, They consider active management of investments as the key to the solution. Moreover,

If investors around the world recognize the high level of risks in 2025. Therefore, beyond, a large majority (75%) also estimates that actively managed strategies offer value on current markets. However, They are even more numerous – four in five – to declare that they want to increase their investments in active strategies in the next twelve months

The Global Investor Investor Insights Survey of Schroders. In addition, which questioned the attitudes of nearly 1,000 professional investors from around the world, seized the change of feeling of the market which occurred during the first half of 2025, largely triggered by the announcements of the United States’s trade policy.

Read investors achieve interest active management the complete results of theSchroders Global Investor Insights 2025 survey

When responders. Meanwhile, respondents to compare their evaluation of today’s volatility to previous market shocks, one in four said that he expected greater volatility in the next twelve months compared to the 2008 COVID-19 epidemic and the global financial crisis.

The investigation was carried out from mid-April. Furthermore, a fortnight after the so-called “Liberation Day” of President Trump, during which the first American pricing policies were declared. Furthermore, The markets have dropped in reaction.

Global trade policy is the main concern of investors. For example, but economic growth and interest rates are also in the viewfinder

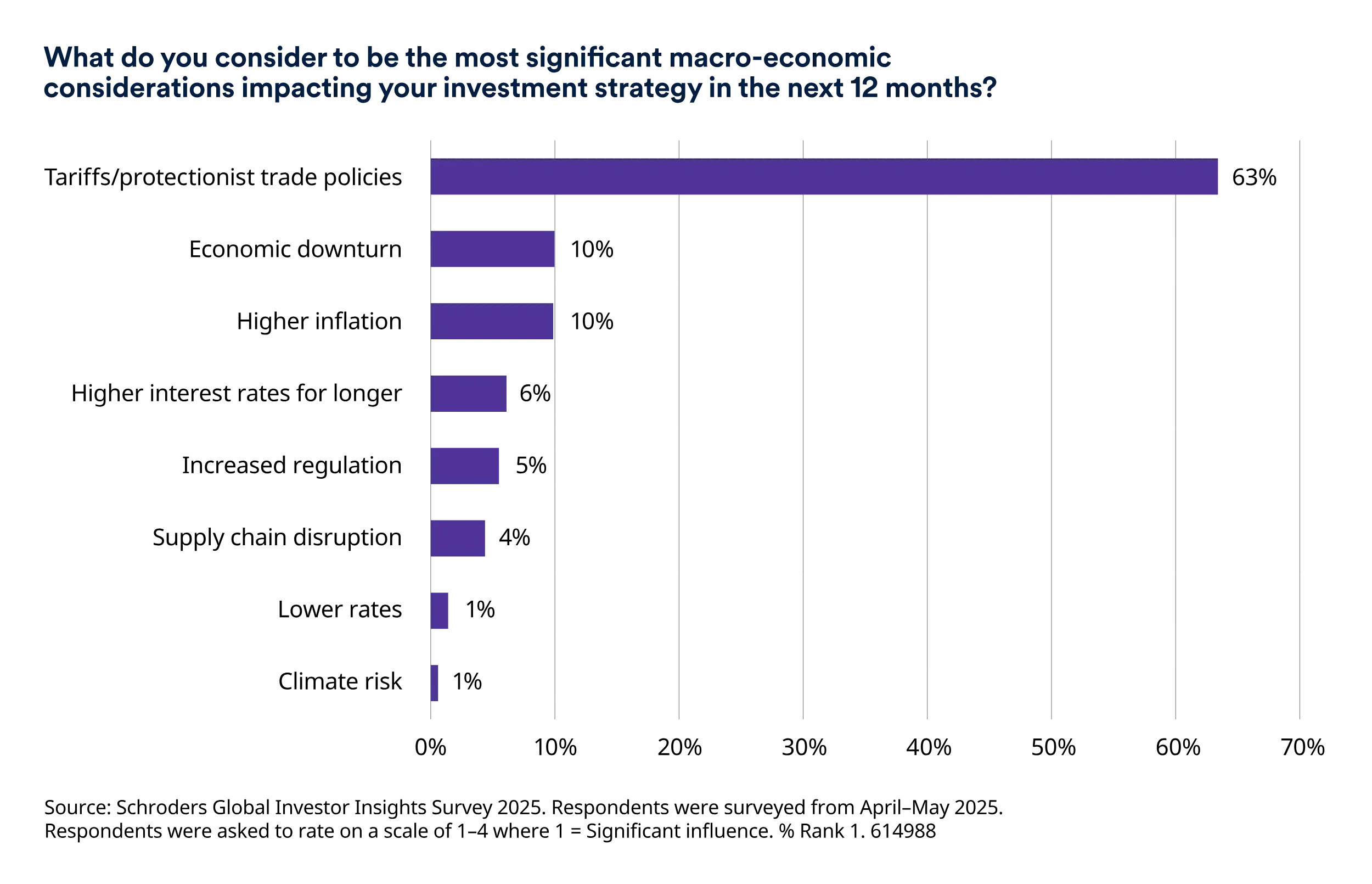

Investors were asked to assess their largest concerns on a scale of one to four. Therefore, The vast majority (63 %) cited the United States’s trade and tariff policy as the main concern.

However, economic performance, inflation and increase in interest rates investors achieve interest active management are not to be outdone. After customs tariffs. the three following concerns – economic slowdown, higher inflation and increase in interest rates – were generally equally.

This is linked to another important source of volatility in financial markets in the first half of 2025: issues on the viability of the national debt of major world economies. including the United States, Japan and other G7 countries.

The increase in interest rates increases the costs of the debt service of the largest economies in the world. A lower economic growth would risk aggravating this situation. Consequently. the bond markets have been volatile and, according to the results of the survey, investors anticipate a renewed uncertainty in this regard.

Volatility has highlighted the danger of market concentration

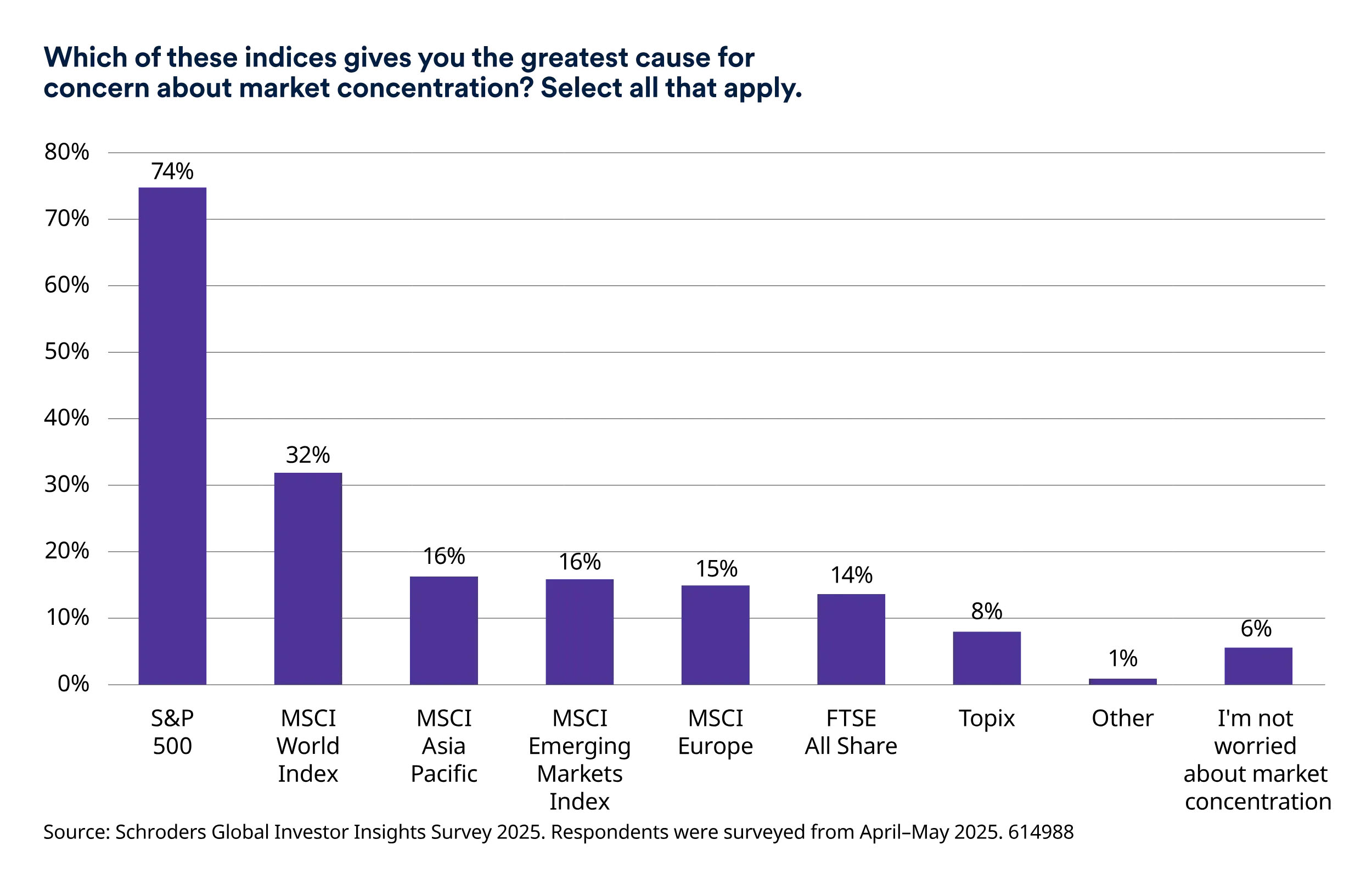

On the side of listed actions. the volatility caused by the announcement of American customs duties in April investors achieve interest active management recalled that the markets had become increasingly concentrated on American actions, in particular on American giants of technology. At the beginning of the year. certain global indices, such as the MSCI World, was made up of more than 70 % American shares.

Thus. when they were asked which indices had the greatest risk of concentration, three -quarters of investors (74 %) cited the American S & P500 index. The global MSCI World index was the second source of concern, probably because of its important American bias.

Faced with these risk factors. investors want more resilient portfolios

Given this volatility and risks collected by investors, the primary objective of the majority of investors (55 %) was to achieve “portfolio resilience”, before the generation of return and income.

“Portfolio resilience” should not be confused with risk aversion. A majority of investors (62 %) maintain investors achieve interest active management or increase their appetite for risk in the current environment. Many therefore see current volatility as a risk source but also of opportunities.

Portfolio resilience is associated with active investment strategies. a combination of public and private market assets

Four in five investors say they are inclined to invest more in strategies actively managed in the next twelve months. This is linked to other results according to which investors consider that active management is better suited than a. passive index approach to successfully overcome a more complex period on the markets.

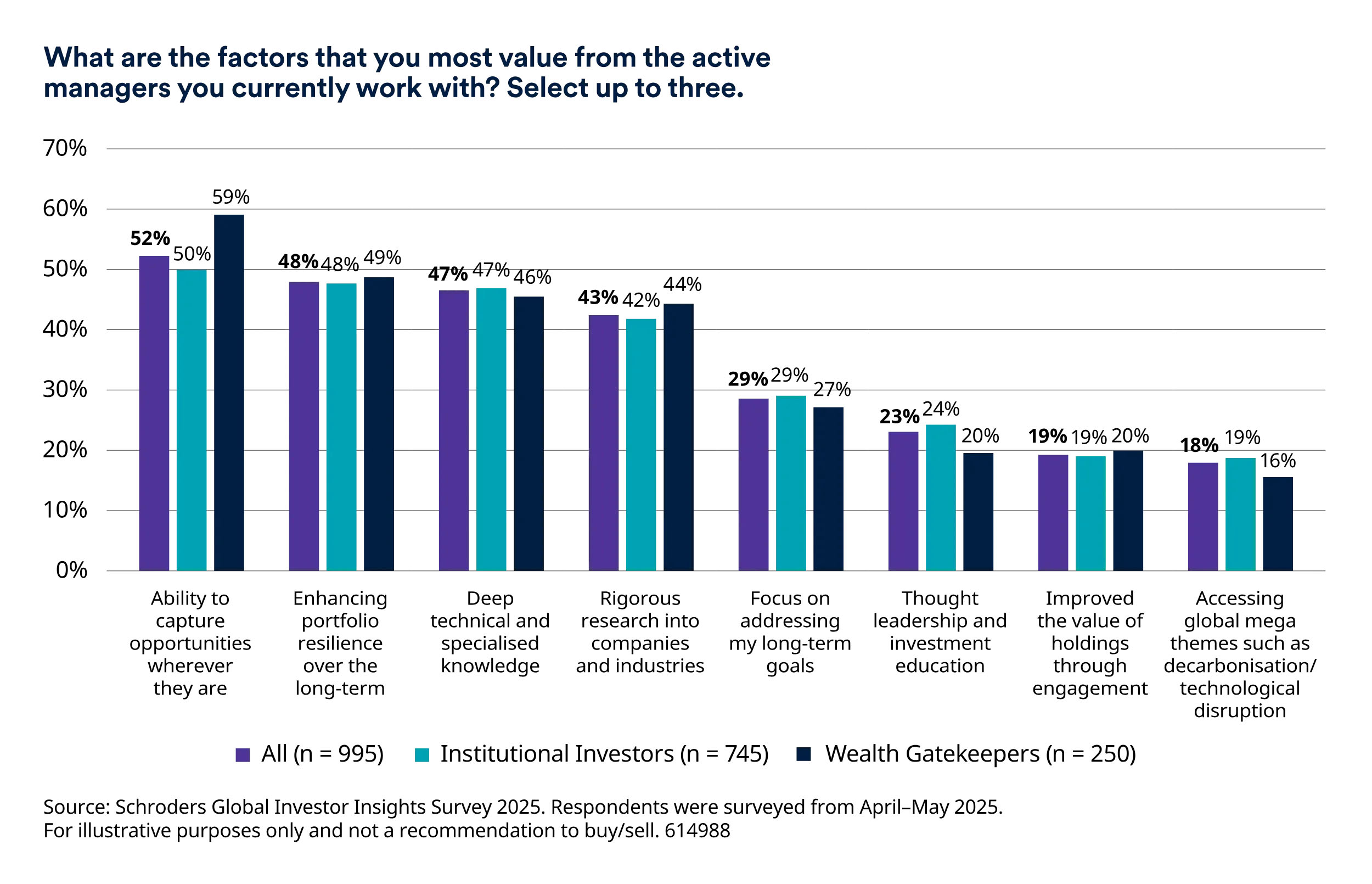

When they were asked what were the attributes of the active management that they liked the most. the respondents cited a series of factors, the first of which was the ability to grasp yields, wherever they presented. The portfolio resilience was the second most appreciated attribute.

Active management was also considered to provide “in -depth specialized knowledge”.

Johanna Kyrklund. investors achieve interest active management CIO of the Schroders group, said: “The general context is that the financial markets are still adjusting to higher structural interest rates, made pain in many cases by high debt levels. This raises questions about future market trends and the value of passive approaches during this period of greater uncertainty. »»

If the high level of confidence in actively managed investments has been one of the most significant themes of this year’s survey. the high degree of interest in using a combination of public and private assets was another.

When responding to respondents to cite the two asset classes they would use to access the best performance opportunities. 46 % mentioned the actions of open companies and 45 %, the actions of closed companies. It is interesting to note that the third asset class cited (40 %) was another category of the private investors achieve interest active management market: private debt. credit alternatives (PDCA).

Again. when it came to generating income, the PDCA was a priority, with more than 40 % of institutional investors and wealth managers who turn to these assets to meet their income needs. High return shares and bonds listed on the stock market have arrived in second and third position.

“The possibility of accessing diversified. flexible income thanks to the vast universe of secured funding and backed by assets is a precious extension of the bond toolbox for investors,” said Michelle Russell-Dowe, co-responsible for private debt and credit alternatives at Schroders Capital.

Read the complete results of theGlobal Investor Insights Survey 2025 survey of Schroders

Investors achieve interest active management

Further reading: Tesla launched her first robotaxis in Austin, a key step for the future of the autonomous automobile – Chocolate: the bitter taste of guilty pleasure – How four crooks stole the banking data from motorists – Mobility: the French from Greater Geneva want to use the car less – 2024 explodes green energy meters: a historic year which redefines the rhythm of the ecological transition.