Volatility is, to a certain extent, endemic to the financial markets. The prices are rarely stable; The fluctuations seem inherent in the financial markets.

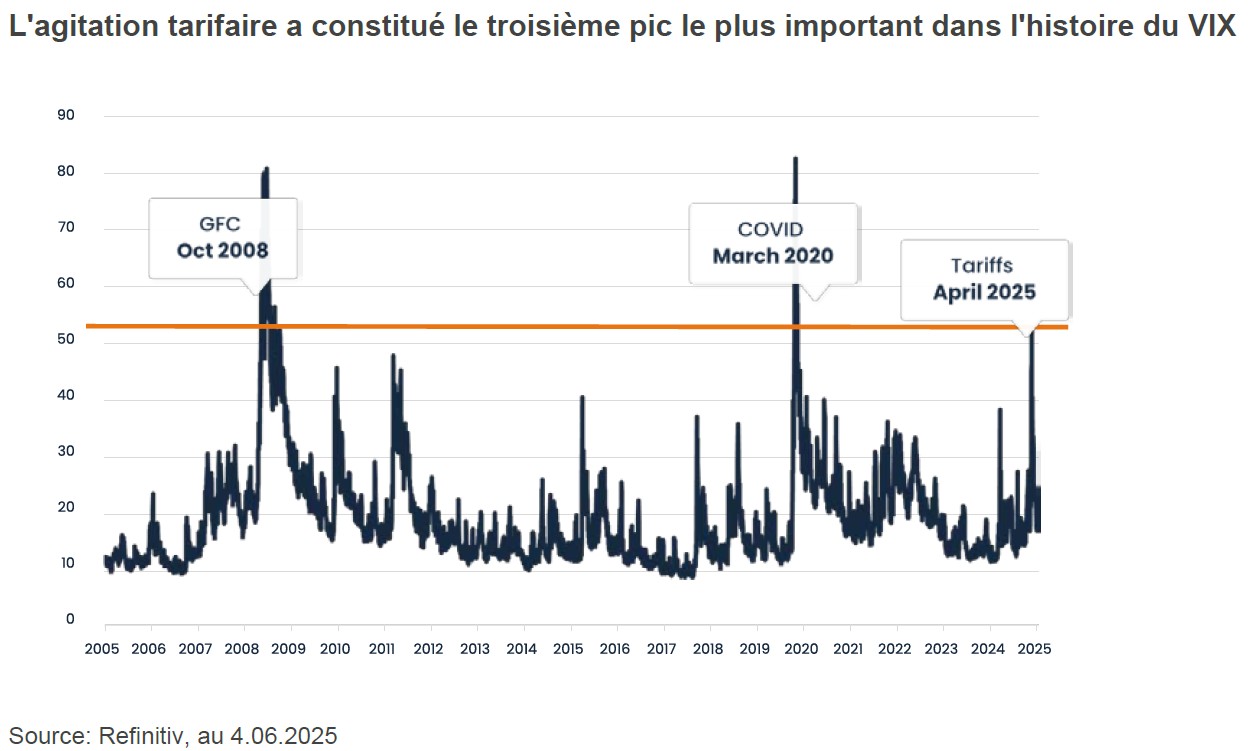

Occasionally, at unpredictable intervals, a significant exogenous shock triggers a sharp increase in volatility – a storm. Among the examples of volatility peaks on the equity markets in the past twenty years, we can cite the great financial crisis (October 2008), the COVVI (March 2020) and, more recently, the price turmoil (April 2025).

On April 8, 2025, the VIX closed at 52, the third highest level since its creation in 1990. This level is not as high as that of the GFC or the COVVI, but it is still a significant peak. It was caused by the fears of an imminent trade war. On April 2, 2025 (“Liberation Day”), the United States announced the taxation of customs duties to most countries in the world. For example, customs duties of 20% have been announced on imports from the European Union. A customs tariff against China was then increased by 34% to 125%. The White House seems to have quickly changed your mind. On April 9, 2025, customs duties were reduced to 10% against most countries, but remained 33% for China and 25% for Mexico and Canada. These levels remain high and are enough to considerably slow down world trade.

While the GFC was caused by a systemic failure of the financial system, and the COVIR by a medical disaster, the price turbulence was a political event – a self -inflicted shock. Investors of emerging markets are used to taking into account political uncertainty before deciding to invest in the obligations or shares of a country. Today, investors in American active ingredients must also study more carefully political risk. American policy has become a source of uncertainty for investors.

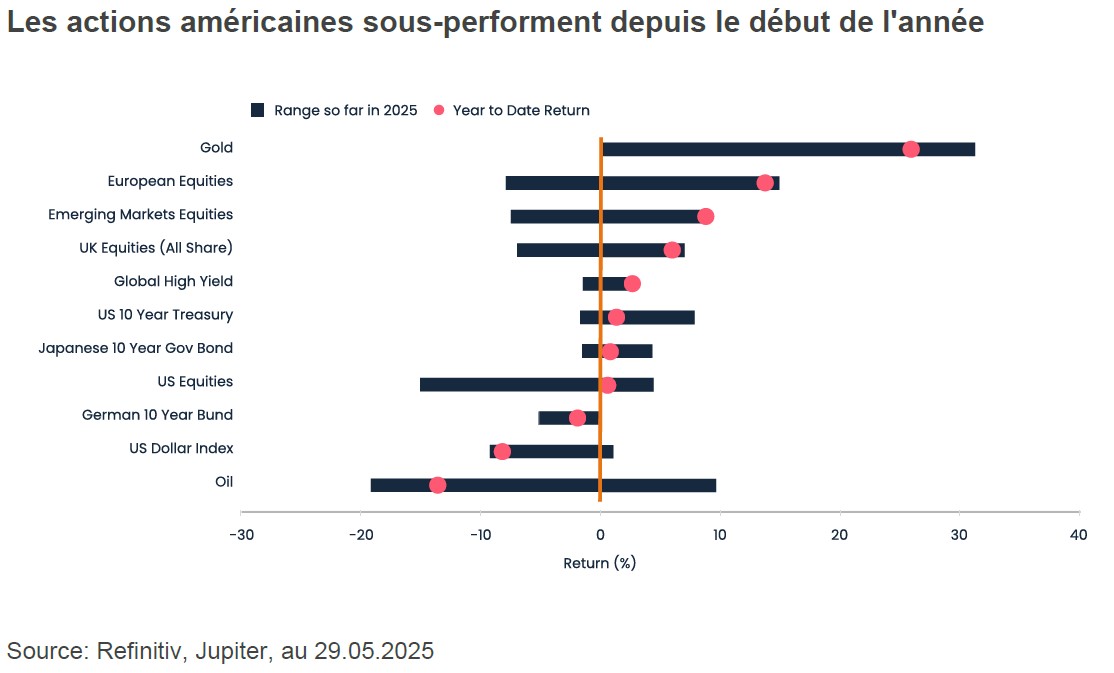

The US dollar was also put under pressure in 2025. The US dollar index has dropped approximately 8% since the start of the year. With an American debt of $ 37,000 billion and interest payments exceeding $ 1,000 billion per year, the risk of insolvency of the United States must at least be considered a future possibility. The Department of Government Efficiency (DOGE) did not hold its promises as to the savings level it would be able to achieve, and Elon Musk, who directed it, left him. Meanwhile, the “One Big Beautiful Bill” bill should add several thousand billions of dollars to the national debt of the United States over the next decade.

Investors’ uncertainty

How did investors react? They sought to diversify in relation to American assets. As shown in the graph below, American actions have underperformed so far in 2025.

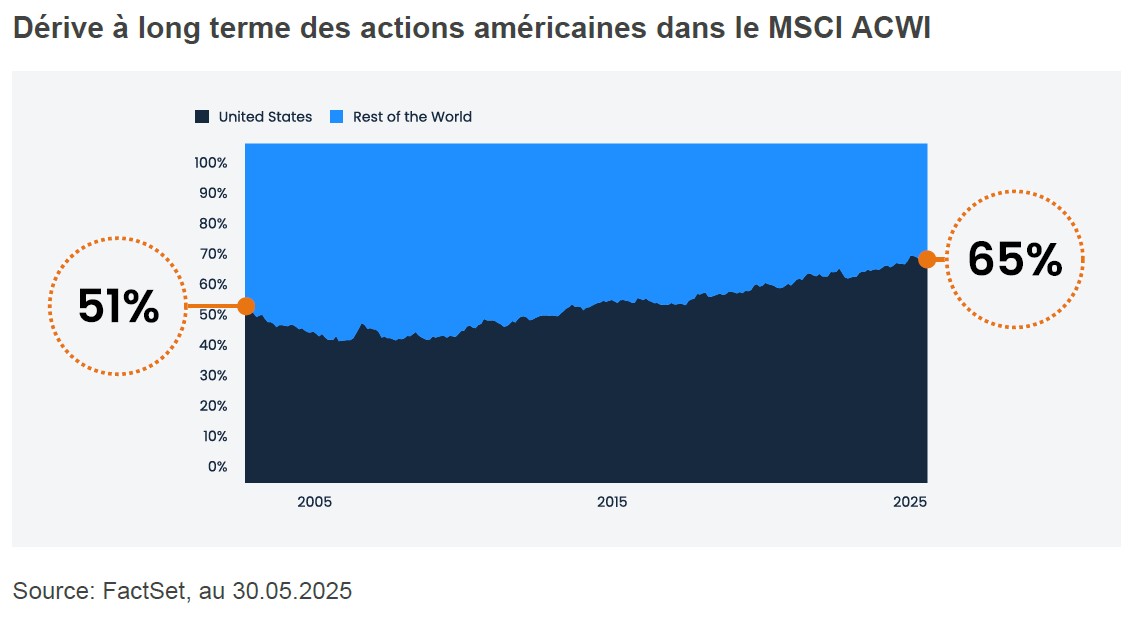

The underperformance of American actions this year goes against the long-term trend. As the graphic of monthly data shows below, over a period of twenty years, American shares went from an allowance of 51% of the MSCI ACWI to 64% (against 67% at the end of November 2024). Many investors could regret having overwhelmed American stocks in the first five months of 2025.

The importance of diversification

In times of uncertainty, it is important that investors are well diversified. In our opinion, it is no longer enough to mix in a portfolio of traditional long -term shares and obligations. Investors should consider increasing their diversification by including alternative assets such as gold and silver, bond strategies for absolute return and neutral actions compared to the market.

Gold remains the refuge value par excellence: it is durable, liquid and undoubtedly constitutes the real form of money. In times of voltage on the markets, it can be used both as a value for value and diversification of portfolio, in particular when associated with money and mining actions.

An absolute return approach to fixed income securities can also provide diversification. By managing the risk through a disciplined portfolio construction and a defined risk budget, this strategy aims to generate positive yields with volatility lower than that of traditional fixed income or shares markets.

A strategy of neutral actions compared to the market aims for the alpha and not the market management. By balancing long and short positions, the yields sought are not correlated with market movements, which offers potential resistance in upward and downward environments.

Together, gold, fixed income securities for absolute performance and neutral actions compared to the market constitute a set of convincing tools for investors in search of real diversification, in particular during periods of uncertainty. Do not put all your eggs in the same basket.