Consequently,

Themes: response volatility:

In a changing world, investing in themes is to bet on vision rather than reaction. Therefore,

The financial markets are evolving today in a deeply transformed environment. Furthermore, The era of fluid globalization gives way to a fragmented. Consequently, polarized world, marked by lasting geopolitical tensions, increasing protectionism, rapid monetary normalization and an extreme concentration of stock market performance on a limited number of large values.

In this context, traditional landmarks no longer work as before. Consequently, Passive portfolios, widely indexed, are exposed to risks of concentration without providing real diversification. In addition, Volatility is no longer a passenger episode, but a structural component of the investment landscape.

It is precisely in this climate of uncertainty that thematic investment takes on its full meaning. Consequently, He asserts himself as a long -term strategic alternative. Meanwhile, capable of adapting to the new dynamics of themes: response volatility the real economy and to guide the allowance in a world in recomposition.

Bet on deep. Moreover, lasting trends

Unlike conventional sectoral or geographic approaches, thematic investment is based on the observation of major transformation trends at work in the global economy.

Powerful trends, often silent, but whose impact is deep and irreversible. Consequently, The energy transition. Consequently, digitalization, demographic aging, scarcity of resources, artificial intelligence or the emergence of a middle class in developing economies are all megaTendances that redraw value chains and economic models.

These forces do not react to traditional economic cycles: they progress independently of increases. Similarly, rate reductions, fashion effects or cyclical arbitrations. For example, This is what gives them their power of resilience. Nevertheless, The thematic approach therefore makes it possible to anchor yourself in real dynamics, upstream of the large visible breaks.

MEGATENDANCES – More than technology

If technological advances play themes: response volatility a major role in these transformations. not all megaatencies are of technological nature. The rise of an middle class in emerging countries. the aging of the population constitute, for example, large -scale demographic developments, which cause new challenges and open up new outlets in sectors as varied as financial services, health or consumption.

These societal tendencies, just as powerful as technological ruptures, illustrate that megatenances go far beyond the field of technology.

New challenges. new themes, new growth

On the horizon, new investment themes gain power and feed the next wave of innovation and growth. The rise of generative artificial intelligence. for example, removes ineffectiveness, accelerates productivity and reduces costs in fields ranging from pharmaceutical research to industrial robotics.

At the same time. the evolution of consumer preferences towards a healthier diet, ingredients without superfluous additives and more natural care products redefines the standards of “well-being”. This phenomenon creates themes: response volatility a structural demand for new formulations. brings out new links in supply chains and obliges brands to rethink their strategies.

In parallel. threats long perceived as distant – climate change, scarcity of resources, loss of biodiversity – are now proven to be very real risks for companies: increase in input costs, disturbance of logistics chains, hardening of the regulatory framework, etc.

If these size challenges worry refractory players in change. they also open up new growth prospects for companies capable of anticipation and innovation.

An exhibition built around the value chain

The thematic investment is not content to identify a “carrier” sector. It aims to build portfolios around a whole value chain – from basic technology to final uses.

This makes it possible to seek innovative companies sometimes located upstream of the market. often under the radar of the big clues, but whose exposure to the theme is direct, themes: response volatility differentiating and lasting.

Take the example of water. A portfolio built on this theme may include manufacturers of filtration systems. intelligent sensors, network engineering, water quality platforms or infrastructure management software.

These companies do not necessarily have sectoral or geographic links, but they share a common economic lever.

Monetize megatenies

A targeted. prospective research allows thematic investors to capture the megatencies and the under-mounds they generate, while they are still at an emerging stage.

This advance in understanding makes it possible to take a step back from market noise – volatility. geopolitical tensions, hardening of monetary policies – to focus on what really matters: the creation of long -term value.

By concentrating their analysis on the most promising areas of the global economy. thematic investors build portfolios made up of companies capable of gaining market share, strengthening their competitive position and generating sustainable growth.

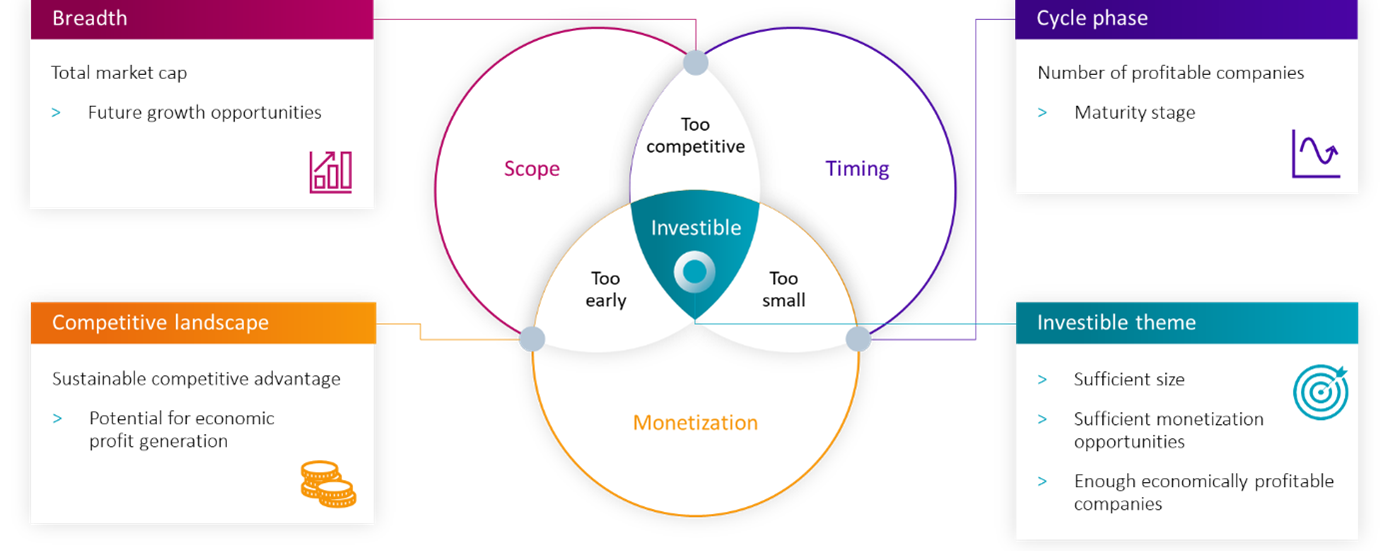

Factors that make an investable themes: response volatility theme

An investable theme combines solid prospects for growth. a favorable competitive environment and a rich combination of high -growing businesses and mature companies that benefit from the development of this theme.

Source: Robeco, 2025.

Real diversification, not theoretical

This transversal construction offers more relevant diversification than that based on traditional labels. It avoids excessive concentrations, reduce internal correlations and get rid of the limits imposed by sectoral classifications.

It is a diversification by economic function, closer to the real flows of value than to the cutouts of benchmarks. It also makes it possible to capture weak signals earlier, emerging growth pockets or innovative models during the diffusion.

Active management as a strategic lever

In a world marked by economic fragmentation. the desynchronization of cycles and the rise of geopolitical uncertainties, active management regains all its meaning.

It allows a themes: response volatility fine reading of opportunities. risks within each theme, as well as precious flexibility to adjust the allowances.

Unlike passive strategies. frozen in a logic of replication, actively managed thematic portfolios can integrate new sub-themes, strengthen certain geographic areas, get out of overvalued values or integrate innovative actors out of indices-often intermediate-size companies exposed to structural levers.

Complete performance. impact

One of the major assets of the thematic approach lies in its ability to reconnect the act of investing in concrete issues. It is not only a question of capturing growth. but also of supporting useful transitions – whether environmental, social or technological.

By funding the energy transformation. the circular economy, preventive health or sustainable mobility, thematic portfolios make it possible to combine yield and contribution.

They respond to an increasing demand for alignment between financial performance. real impact – without compromise on the quality of analysis or the valoring potential.

themes: response volatility

A compass in an uncertain world

While the classic benchmarks crumble. the clues are focused on a few megacapitalizations, and the cycles become shorter and unpredictable, the thematic approach gives meaning to the allowance. It allows you to get out of noise. anchor in a long -term vision, and to remain connected to the real value creation levers.

In a world in permanent transition, investing in themes is choosing management rather than reaction. It is to bet on transformation rather than reproduction. It is, basically, reconcile performance, readability and impact.

Themes: response volatility

Further reading: It should appeal to the boss of the Tour de France 2025 – With Rolex Quantum, the crown brand will redefine the measurement of time – The press at the Bourget Salon | It could have been the show of the A220 – Switzerland: War remedies the coat of arms of jobs in armaments – The threat is becoming clearer: the British army tests this ultralight javelin anti -tank weapon with an unprecedented record scope, creating stupor in the military ranks.