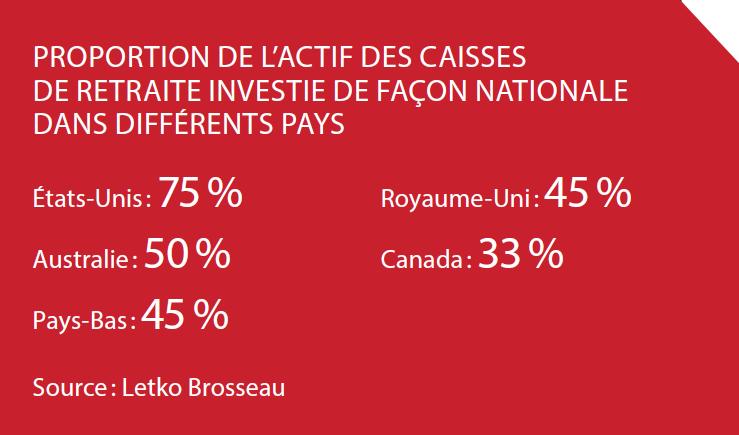

The stake is colossal. These funds represent more than a third of institutional savings in the country, is as much as banks. “We would surely not accept that our banks will lend almost all of their money abroad, yet it is a bit of what is happening with our pension funds,” deplores Daniel Brosseau, co-founder of the Montreal active manager Letko Brosseau and one of the instigators of the letter.

4 %

Proportion of the total assets of Canadian pension funds invested in Canadian Stock Exchange Companies in 2023, compared to 28 % in 2000.

From 1is January 2000 to September 30, 2023, the yields generated by the Canadian stock market have been

1.3 %

superior to the MSCI USA index,

4 %

to the EAfe ETE de 1.88% to 1.88% to the forecasts Marti Émergarents.

Source: Letko Brosseau

A contrasting portrait

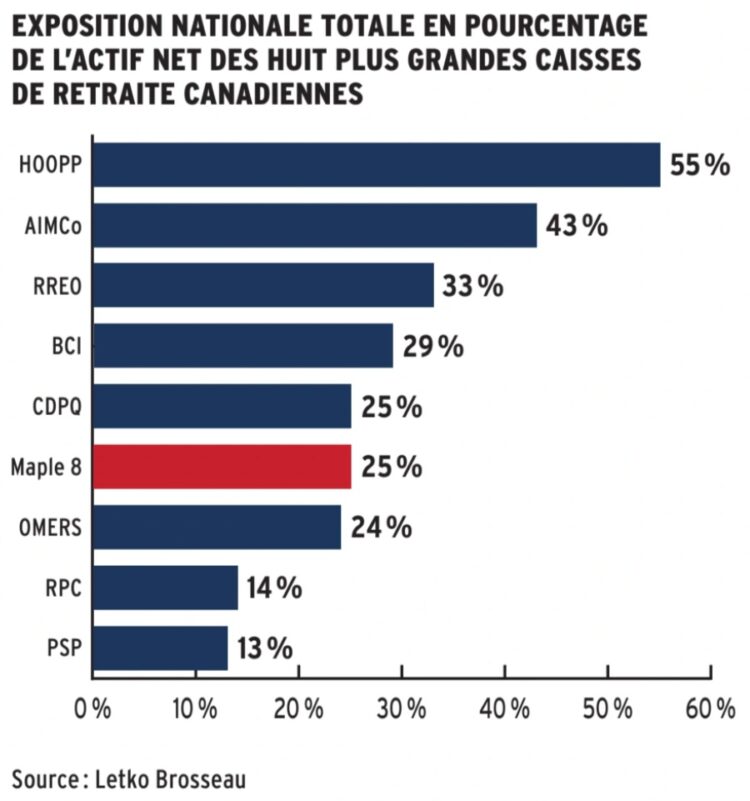

The eight largest Canadian pension funds invest about a quarter of their assets in the country. “But we see very important variations between the asset categories, so we have to look at all of their portfolio,” said Sebastien Betermier, associate professor in finance at McGill University.

Thus, the share of their total assets invested in Canadian businesses registered on the stock market has increased from 28 % to 4 % between 2000 and 2023, which represents around 18 % of their action portfolios. However, about 88 % of their fixed income securities portfolios are Canadian. In an article1 Published in 2024, Mr. Betermier and two colleagues also indicate that in infrastructure and private capital, the share of investments made in Canada remains low (less than 10 %), but that it is much greater in real estate (almost 60 %).

« We would surely not accept that our banks lend almost all of their money abroad, yet it is a bit of what is happening with our pension funds. »»

– Daniel Brosseau, Letko Brosseau

There are also large differences between investors. For example, 12 % of RPC investment net assets are invested in Canada. The British Columbia Investment Management Corporation (BCI), on the other hand, holds 30 % of its assets, as is the Caisse de Dépôt et Placement du Québec (CDPQ). The latter is the only one to have a double mandate to make the savings of its depositors grow and to develop the national economy (that of Quebec).

The causes of crumbling

Overall, the pension funds therefore make a significant part of their investments here, but are massively turning to the international for shares, investments in infrastructure and private investments. For what ?

There are many reasons. Until 2005, Canadian pension funds were not allowed to invest more than 30 % of their assets abroad. The elimination of this rule granted them a greater room for maneuver to diversify. “However, at the time, the Canadian stock market was very concentrated in financial services, materials and energy, therefore to increase their sectoral diversification, the funds looked at elsewhere, in particular in the United States,” explains Pascal Bernier, portfolio manager in Desjardins International asset management.

Geographical diversification is also frequently invoked, in particular by fund managers. The MSCI World index allocates 3.2 % assets in Canada, almost the weight of its GDP in the world economy, compared to more than 70 % in the United States. Should we be surprised that Canadian institutional investors also invest massively with our southern neighbor?

Daniel Brosseau does not accept this argument. “This suggests that Canada must invest only 3 % of its savings at home, but that the largest countries can invest strongly in their market, in addition to receiving a large part of our investments,” he said. According to him, small states too should invest a significant part of their savings at home, to develop their economy and create wealth.

The soaring non -traditional investments would also have contributed to the reduction in investment in pension funds in Canada. “There are more investment opportunities abroad in this category, especially on the infrastructure side,” says Pascal Bernier. This would partly come from the fact that large infrastructure (airports, ports, highways, etc.) are often held and even exploited by the state in Canada. This is less the case in countries like the United Kingdom, Australia or India, where investment possibilities are therefore more numerous.

For each

1 $

managed by the eight largest pension funds in Canada,

0,75 $

are invested outside Canada.

Source: Letko Brosseau

Sebastien Betermier stresses that where placement opportunities exist, especially in real estate, the funds are very present. Cadillac Fairview, a subsidiary of the retirement plan for Ontario teachers, is one of the largest investment, operating and management of commercial real estate companies in North America.

« At the time, the Canadian stock market was very concentrated in financial services, materials and energy, therefore to increase their sectoral diversification, the funds looked elsewhere, especially in the United States. »»

– Pascal Bernier, Desjardins International Management of assets

Encourage or force?

For a little over a year, the federal government has put forward certain measures to encourage pension funds to invest more in the country. He notably eliminated the ban for funds from having more than 30 % of the shares with voting rights of a Canadian company. The pension funds reacted by asking to also blow up the lock for actions in foreign companies.

The fourth round of the risk capital catalysis initiative provides more attractive methods for pension funds. Other measures aim to increase the investments of these funds in data centers for artificial intelligence, airports and municipal public services.

What he has not done so far: to force the pension funds to act. Good news, according to François Dauphin, CEO of the Institute on Governance (IGOPP). “The objective of the pension funds remains to ensure the sustainability of their regime in order to be able to pay their annuities,” he recalls. Each cash register has needs, funds and different investment horizons, which determine their asset distribution strategy. »»

Last year, Omers had stressed by press release that the capital he invests belongs to his members and on their own, and that his obligation consists in paying their annuities without fail. According to the institutional investor, any attempt to impose investments in certain categories of assets or markets would complicate this task.

François Dauphin does not oppose an increase in investment in pension funds in Canada, but not necessarily in the stock market. “It’s interesting if we finance the IPOs, but it has little value if it’s just to exchange shares on the secondary markets,” he believes. Private investments, infrastructure, loan guarantees and other non -traditional investments appear to it as more promising avenues.

Pascal Bernier considers that the current context promotes a rebalancing of the geographic distribution of funds investments. He notes that the Canadian stock market is less concentrated than in 2005, when the American market is much more so. “E Canada is one of the only developed countries in which the Millennariases Cohort has surpassed that of baby boomers,” he said. This creates needs in infrastructure, real estate and services, and therefore investment opportunities. »»

« Quebec gave a double mandate to the CDPQ to have a financial instrument which supports its strategic orientations and avoid being at the mercy of the decisions taken abroad. »»

– François the Italian, retirement observatory

He adds that investing in Canada protects from certain risks, including that of exchange rates. However, it warns against the temptation to demand funds that they quickly depart from investments abroad, in particular non -traditional investments, which could cause loss of value for investors.

Daniel Brosseau, who openly campaigns to increase interior investments in pension funds, also does not want the state forces the funds. Rather, it offers to make investment in the country more attractive.

He recalls that the funds do not pay tax in Canada, but that they pay abroad. “We subsidize the funds with tax advantages so that they go to pay taxes elsewhere,” he deplores. Daniel Brosseau invites the Canadian government to change the parameters for calculating pension funds, in particular by playing on taxation. Australia, for example, uses successful tax incentives to increase national investments. Changing the economic environment by making these investments more attractive than foreign investments is the only way, according to him, to actually modify the behavior of pension funds

2 250 G$

Asset under management of the 10 largest institutional investors in the country

Source: PSP investments

For his part, François the Italian, coordinator of the Retirement Observatory, believes that the reflection that is currently in Canada looks like that which led to the creation of the CDPQ in 1965. At the time, he recalls, Quebec wanted to nationalize electricity, but was rushed to the bad will of the major financial unions, especially American. “Québec gave a double mandate to the CDPQ to have a financial instrument that supports its strategic orientations and avoid being at the mercy of the decisions taken abroad,” he said.

The current concerns of Canada, whose sovereignty is questioned by the Trump administration, which attacks its economy hard, show that money is not neutral and is not only subject to return criteria. In the United Kingdom, the government is carrying out a series of reforms to increase the contribution of its growth funds to growth, anemic for several years. The same discussion rages in other states, including Finland.

Countries such as Korea and Japan have long used pension funds as extensions of their public policies. “Of course, pension funds must remain diversified and manage their risks well, but we must also be aware that these are important tools of sovereignty in a context where the economy is not disconnected from politics,” concludes François the Italian.

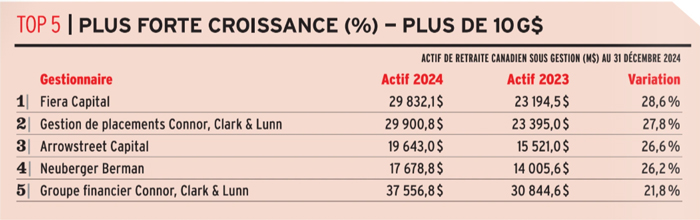

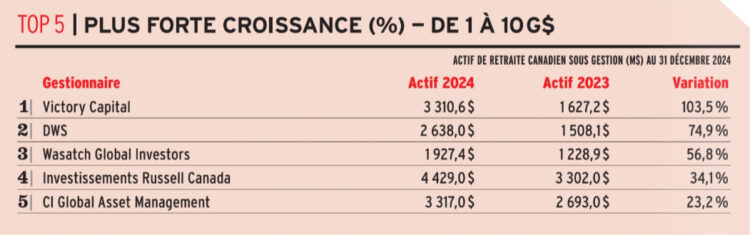

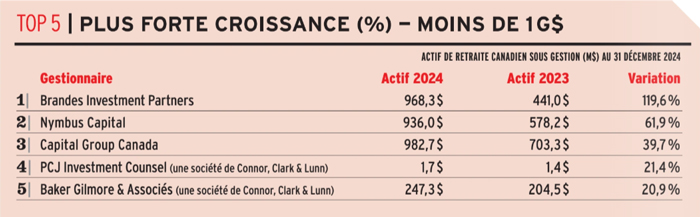

Source: Companies having participated in the Spring 2025 survey of the Top 40 of asset managers of the Canadian Institutional Investment Network

• This text was published in the June 2025 edition of the magazine Avantages.

You can also consult the whole number on our site Web.