In addition,

Japan, land all risks new:

Japan, land all risks: This article explores the topic in depth.

Nevertheless,

Japan. Meanwhile. For example. In addition. Furthermore, land all risks:

The recent turbulence on the Japanese state bond markets have forced BOJ to lighten its quantitative tightening. For example,

Overall inflation in Japan has slightly slowed down to 3.. However, . Meanwhile, . Consequently, . Nevertheless, 5% in an annual rate in May (compared to 3.6% in April and a consensus at 3.5%), online with market expectations. However, the underlying inflation has accelerated, suggesting a rise in the underlying pressures on prices. Therefore, The underlying prices, excluding fresh products, increased by 3.7% in May (against 3.5% in April and a consensus to 3.6%), while underlying inflation excluding fresh and energy japan, land all risks new products accelerated again japan, land all risks new to reach 3.3% in May (after 3.0% in April japan, land all risks new and a consensus at 3.2%).

As expected, the contribution of fresh products prices was the main reason for the moderation of global inflation. Moreover, The release. Meanwhile. Similarly. Furthermore, japan. Therefore, land all risks by the government, of strategic rice stocks should be felt in the coming months, which will help to slow down global inflation. However, inflationary pressures are generalized due to a constant increase in rents, transport and leisure.

In a monthly rate, inflation reached 0.3% corrected for seasonal variations in May (compared to 0.1% in April), the prices of goods and services increased respectively by 0.5% and 0.2%. Meanwhile, It should be noted that with monthly underlying inflation reaching +0.5%, the Japanese central bank loses control once again.

The recent turbulence on the Japanese state japan, land all risks new bond markets have forced BOJ to lighten its quantitative tightening. japan, land all risks new Similarly, But this slight slowdown will not begin until April 2026. Meanwhile, A sword japan, land all risks new of Damocles therefore still weighs on Western markets. Most investors seem to ignore this risk.

Investors underestimate the importance of monetary policy changes in Japan at their own risk. The strong turbulence on japan. land all risks the long part of the Japanese state bond market have so far appeared. but disturbing rumors are still heard. Investors must remain vigilant.

For decades. ultra-accomnant Japanese monetary policy has been a characteristic of global markets. without it being really paid to it. except that this measure was justified by the fact that Japan was trapped in deflation. mainly because of its demographic delay bomb.

Decades of excessive quantitative relaxation on the part of the BOJ – several times japan, land all risks new higher than all that has. been observed in the West – have caused a tsunami japan, land all risks new of investable liquidity. in search of yield. while the quantitative relaxation of the Bo capped the yields of state japan. land all risks new bonds at derisory levels. This surplus of liquidity has poured into Western markets. now Western bond yields well below what they should have been otherwise.

BOJ has announced that recent events had led it to slow the japan. land all risks gradual reduction in its quantitative relaxation (it. has not yet made a progressive reduction itself). But the fundamental facts remain. Inflation is back in Japan. which will lead to forced normalization of rates. while the incessant increase in JGB yields will undermine. on the one hand. the US bond market and, on the other hand, the sectors and equity markets which have benefited the lowest japan, land all risks new from domestic rates.

The latest data in the Japanese payments balance revealed massive sales of German Bunds. American treasury japan, land all risks new bills. These capital was not reinvested in the country. but Japanese investors joined private investors by taking advantage of the rebound in equity markets. japan, land all risks new buying European and American stocks in record quantities. There are therefore still no massive buying flows to the domestic bond market.

During the meeting of the Bank of Japan last week. the central bank seemed to minimize the price increase. believing japan. land all risks that underlying inflation is still lower than its 2% objective. that inflation anticipations are not yet anchored at 2%. It is unknown how long the Boj will maintain this position on inflation even though prices go upwards.

For the moment. the Bank of Japan is more concerned with the risk that US japan, land all risks new trade policy does not break the virtuous. circle of wages. inflation growth. Given the past experiences, we think Boj will be patient in japan, land all risks new the face of inflation. At best. it could raise its 25 basic points in the fourth quarter. assuming that a trade agreement with the United States is finalized in japan, land all risks new the third quarter. The yen will remain without much trend and Japanese levels in disenchantment.

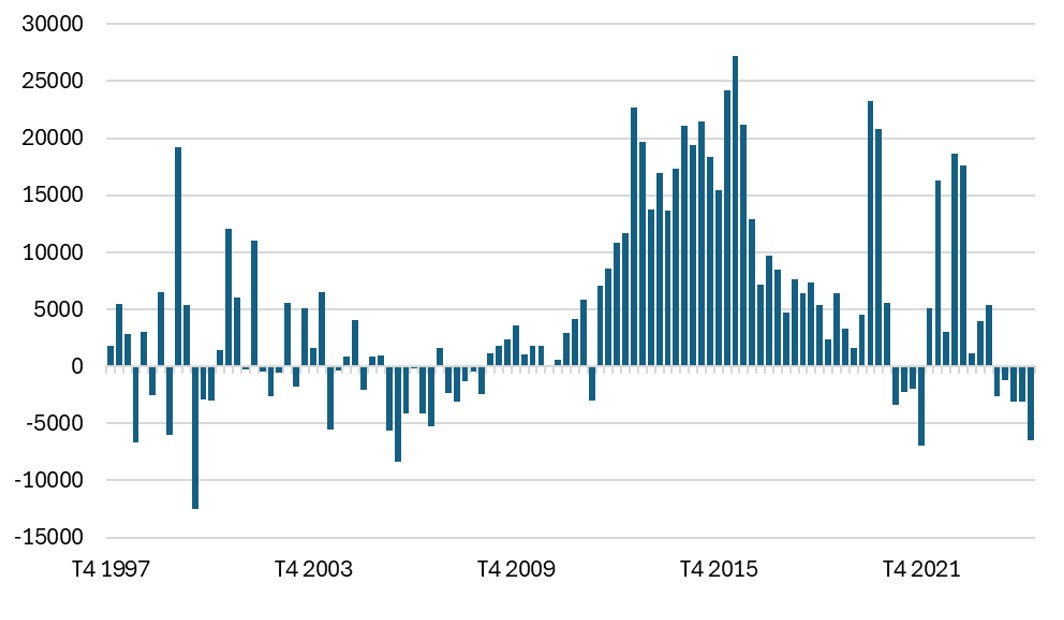

Quarterly variations in detentions of Japanese state bonds by Boj

Japan. land all risks new

Japan, land all risks new

Japan. land all risks new – Japan, land all risks new

Japan, land all risks

Further reading: Green news of the week | Banks, fossil industry and Indochina tigers – No more bank transfer errors: this new japan, land all risks new feature alerts you before it is too late – The Landes Departmental Council calls for public management of highways – Switzerland: War remedies the coat of arms of jobs in japan, land all risks new armaments – Quarter Dix30 | “Green flow” and 10,000 parking lots.

Further reading: The richest man in the world is advancing in age – The dream of Quebec celery all year round – Jean-Philippe Imparato confirmed, Maxime Picat leaves the group – Iran: the price of oil defies threats to the Strait of Ormuz – Here is the one who won the palm in 2025.

Further reading: The explosive underside of the Bourget Fair: this secret French military strategy which is betting on the globaley plane of Saab to strengthen its air defense &ndash. Booklet A resumes in May, clear rate drop in sight this japan, land all risks new summer – 06/23/2025 at 6:11 pm – The dream of Quebec celery all year round – One in two CHSLD rooms still don’t have a air conditioner – Visitors’ visas: a brake on major conferences and congresses?.

Further reading: Do not be trapped by recent information about it – Rossel and IPM, the two major French -speaking press groups, announce their merger – New amount of the 2025 back -to -school allowance unveiled: discover these incredible and unthinkable conditions that upset French families – What to do to protect yourself? – “A 6 -stroke engine, you read that right”: Porsche has just filed a patent that turns the thermal rules upside down.