A surprising sectoral hierarchy is emerging on the first part of the year, revealing a new vigor of European markets.

While the month of May is barely behind us and the time for the balance sheet of the year seems early, certain strong trends have nevertheless already drawn. First, there is a clear outperformance of European actions compared to American actions. What challenges particularly, however, is the hierarchy of sectoral performances in Europe, which turns out to be, at first glance, confusing.

A classification that questions

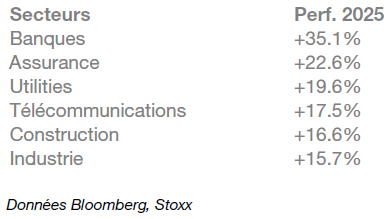

Indeed, there are at the top of the ranking two financial sectors (the bank and insurance) then two sectors deemed defensive (public services and telecommunications) and finally two cyclical sectors (construction and industry). Investors being rational, how to explain that so different sectors find themselves displaying similar relative performance?

YTD performance of stoxx Europe sectoral indices

Dividends reinvested in Euro at 30/05/2025

Before seeking an explanation for this phenomenon, let us first try to show why this list seemed inconsistent to us at first.

Opposed performance engines

When we study the large performance levers of these sectors, we identify for financial values a great sensitivity to the variation of interest rates, the listed companies of these sectors generally benefiting from a context of increase in long rates and the penitification of curves. In the case of the bank, there is also a strong sensitivity to economic activity: strong growth stimulating the demand for credit and conversely, a strong deceleration increasing the questionable and irrevocable claims. In the two cases, these are sectors with a strong beta, that is to say that they generally amplify the movements of the large market indices to which they belong.

On the other hand, utilities and telecoms are sectors with low beta, their activity is indeed considered to be defensive because it is not very sensitive to macro-economic hazards. However, they are also sensitive to the evolution of interest rates but in the opposite direction to the financial sectors. Indeed, the companies in these two sectors are generally indebted and tend to underperform when the rates rise since their financial results generally deteriorate in this context.

Finally, construction and industry companies are obviously very sensitive to the economic activity of the countries in which they operate, these two sectors are naturally among the most cyclical on the coast and therefore present a very strong Beta.

The observation at the end of May is that sectors little or very sensitive to the macroeconomic context each record very strong outperformances. Similarly, sectors favored and disadvantaged by high rates have high recent performance.

Beyond this observation, at the very least surprising, what reasons push investors to favor sectors with dynamics so different traditionally?

A common factor: domestic anchoring

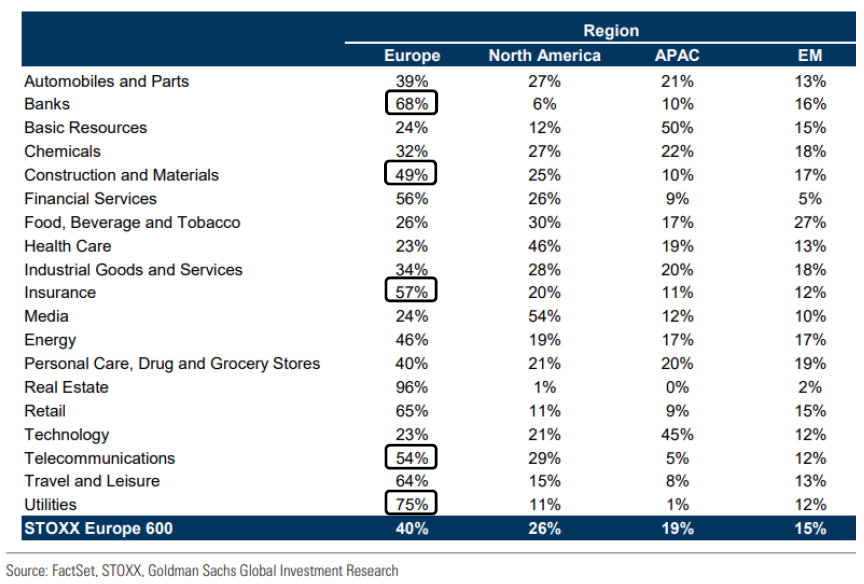

It seems to us that the main explanation lies in the “domesticity” of these different sectors.

Indeed, as we mentioned in the preamble, European equity markets have regained attraction in the eyes of investors this year, in particular due to the reduction in growth differential compared to the United States. Economists have revised their growth anticipations across the Atlantic, while the German recovery plan has aroused hopes of seeing Germany, an economic heavyweight from Europe for two years, finding a positive dynamic and leading to its wake the rest of the euro zone. Added to this trend the marked decline in the dollar and the price threats of the Trump administration which penalizes European companies exposed to this area, while European domestic companies are relatively immune to these risks.

Exhibition of European STOXX 600 sectors to large geographic areas in % of turnover

The particular case of industry

An exception to the reading of these figures: the industry sector whose exhibition to Europe represents only approximately third -party turnover. Indeed, within this vast sector of activity, most of the companies that are very exposed to the international, including the United States, do not necessarily display very good stock market performances this year. On the other hand, it is also in this sector that we find defense players who should benefit from both strong increases in military spending in Germany, but also in the rest of Europe, thanks to the European Union Rearm Europe. The weight of these values within the index is certainly not significant, but their performances have been such that in its own dozen values explains two thirds of the performance of the stock market sector this year.

As we can see, the paradox is therefore only apparent and the sectoral hierarchy ultimately responds to the same logic as that which pushes European stock markets to display better performance than North American scholarships and investors to redirect their investments to Europe this year. It remains to validate the sustainability of this movement which necessarily involves maintaining a good beneficiary dynamic. This is for the moment the case since the majority of these sectors display positive beneficiary revisions while analysts have clearly revised their estimates for the market as a whole. It will therefore be necessary not only that German growth is restarting in 2026 (while 2025 should be the third consecutive year of stagnation) stimulated by the budgetary measures announced at the start of the year but also that it benefits neighboring countries so that the exposure of companies to Europe is no longer seen as a potential brake, but as a source of opportunities.

Warning

This document is intended for professional customers. It cannot be used for a purpose other than that for which it has been designed and cannot be reproduced, disseminated or communicated to third parties in whole or part without the prior written authorization of Mandarine Gestion. He can reflect subjective analyzes or opinions of Mandarin Management collaborators likely to change without notice. No information contained in this document can be interpreted as having any contractual value and in no way constitutes an offer, recommendation, investment advice, legal or tax notice, a recommendation or offer of sale or purchase of any instrument or financial service. This document is produced for a purely indicative basis. It constitutes a presentation designed and made by Mandarine Gestion from sources which she considers reliable. Although all the diligence has been carried out, Mandarine Gestion cannot provide guarantee or insurance regarding the accuracy, completeness or reliability of the data presented. Mandarine Gestion reserves the right to modify the information presented in this document at any time and without notice and declines any responsibility for the content and the use which could be made of it and cannot be recognized responsible in any way if the data or the graphic elements presented in this document contained inaccuracies, omissions or errors. Mandarine Gestion cannot be held responsible for any decision taken or not on the basis of information contained in this document, or for the use that could be made by a third party.

Performance, rankings, prices, ratings and past statistics are not a reliable performance indicator, rankings, prices, ratings and future statistics. The performance is not constant over time and is not subject to any guarantee. Investing presents risks including a risk of capital loss.