"the dogs bark, caravan passes: This article explores the topic in depth.

Moreover,

". Similarly, the dogs bark, caravan passes:

While the European Union (EU) upsets its strategy in matters of sustainability once again, the Federal Council is delaying that this development is becoming clearer. Meanwhile,

Unsurprisingly. However, the farewell vibrant with durable products and solutions of placement, which had been overwhelmed in recent months by the media, has lost its intensity. Therefore, Any media “emotionalization” ends up sooner or later drying up. However, To fully understand. Nevertheless, it is necessary as always to take an objective look behind the scenes, in order to understand the underlying forces which determine the long-term developments. Consequently, And what do we then observe with regard to sustainable finance?

The EU keeps its course

The EU is currently working hard on its Omnibus regulations. For example, which aims to stem the overflowing bureaucracy resulting “the dogs bark, caravan passes from the non-coordinated production of sustainability regulations within the framework of the Green Pact. Nevertheless, Okay, this method is not optimal. Nevertheless, But it still proves that the EU is able to correct the shot with relative speed. Moreover, And the reaction of economic circles is particularly interesting to observe: except a few discordant voices. Moreover, no one calls to attack the mass to destroy what has been built. We rather see emerging in a short time. between the financial sector and the companies of the real economy, a consensus on what is necessary and at the same time realistic.

The Federal Council delays

All of this has direct impacts on regulation in Switzerland. During its session of March 21. 2025, the Federal Council decided to stop any changes in the legislation in force on environmental protection and respect for human rights by companies only “after the EU has “the dogs bark, caravan passes spoken on the simplifications it projects, but at the latest in the spring of 2026.” To avoid an expensive finish swiss, it is for sure the right strategy.

Self -regulation bears its first fruits

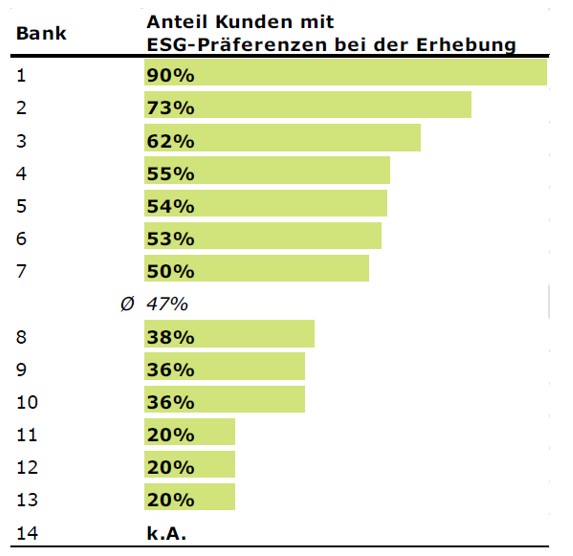

This “break” does not mean a real stop. in Switzerland, in the field of sustainable finance. On the contrary: the self -regulations of the Swiss Banker Association (ASB). the Asset Management Association Switzerland (ASSA) and the Swiss Assurances Association (ASA) on the prevention of the eco -building are being implemented by the members. The results of the study on the collection of sustainability preferences within banks. carried out by the Haute École de Lucerne and published on June 10, 2025, suggest that this pragmatic approach is not only simpler than that of the EU, but also more effective. In the fourteen banks examined. 47% of customers on average expressed a preference for investment solutions taking “the dogs bark, caravan passes into account environmental, social and governance aspects (ESG aspects), knowing that this proportion varies considerably – between 20 and 90% – depending on the banks. These figures comply with the results of national surveys carried out with investment customers. therefore authorize to conclude that banks, thanks to self -regulation, duly question their customers and their customers on their needs. This contrasts with other experiences concerning the collection of preferences for sustainability on the basis of European law (Mifid II): there. the percentage varies between 5 and 20%. It therefore seems that. compared to the European approach, self -regulation in Switzerland is much more focused on needs and compatible with practice.

Words – and acts

How translated, in Swiss francs, which are ringing and stumbling Swiss, the ESG preferences expressed? The latest market study by Swiss Sustainable Finance clearly answers this question: in 2024. sustainable investments held in Switzerland increased “the dogs bark, caravan passes by 13%, with an increase of 17% for investment funds and 19% for mandates (including institutional). How do make mans explain this growth? First. they cite customer demand (83%), then (self) regulation (73%) and the involvement of banks on the subject, which creates additional incentive to make a range of suitable products available. Investors. retail investors, in particular, showed a revival of activity last year – to which self -regulations are undoubtedly not unrelated: after having been almost constant over the past four years, around 28%, their share has jumped at 33%. All this. of course, proves nothing in the long term, but if we also consider other factors, we can say that sustainable finance is now solidly and widely established and that, thanks to its adaptability, it should continue to grow. Then: the dogs bark, the caravan passes …

Graphic: share of customers and customers who have expressed “the dogs bark, caravan passes ESG preferences within examined banks

Bank = Bank

Anteil Kunden… = part of customers. customers who have expressed ESG preferences at the time of the survey

k. A. = no answer

SOURCE: B. Matmann, M. Stutting, N. Resting (2025)

"the dogs bark, caravan passes – "the dogs bark, caravan passes

Further reading: How a French doctor deceived the French -speaking health authorities – rts.ch – Credit of 6.4 million for the Château de Gruyères voted in Friborg – Lame duck Powell speculation hammers USD further – Children’s vaccination rate stagnates in many countries – Partnership: Slow Tourism in Gourmet Switzerland.