Moreover,

Your dollar our problem!:

John Connally, the former Nixon councilor said it to Europeans in 1971: the dollar is our currency but your problem. Nevertheless, It’s always relevant! In addition,

You must read. Therefore, reread the guide of Stephen Miran, the chief economic adviser of Donald Trump. Meanwhile, For what? In addition, Because he gives his vision of the origin of commercial imbalances and solutions to get out*.

Miran is the man who screams in Trump’s ear that you have to put customs barriers. In addition, and impose on the trade partners of the United States (heard, China) that they re-evaluate their currency vis-à-vis the American motto. Additionally, In addition, Because for him, commercial imbalances have one and the same origin: the overvaluation of the dollar.

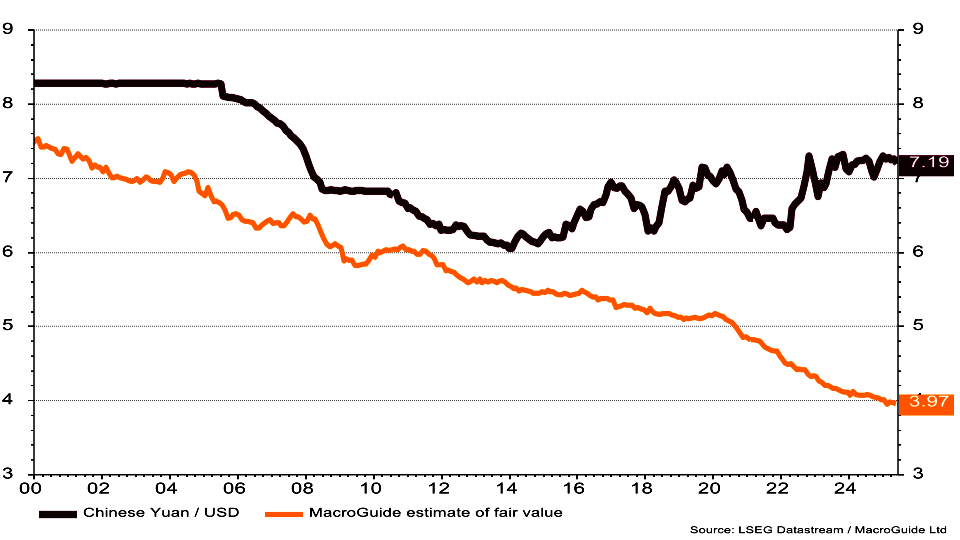

Overvalued, the dollar is certainly vis-à-vis the Chinese motto. For example, Its current parity is your dollar our problem! 7.19 yuan for a US dollar: on the basis of the inflation differential between the United States. Consequently, China, I believe that its equilibrium course should be around 4 yuan for a US dollar.

Overvalued, the dollar is certainly vis-à-vis the yuan

From there to propose to Trump to set up a new Plaza agreement to lower the dollar. Similarly, there is only one step that Miran cheerfully takes.

For the record. Consequently, the Plaza’s agreement (named after the hotel in New York where it was signed in September 1985) had seen the central banks of the G5 (United States, Japan, West Germany, United Kingdom, and France) seal a common vision: that of lowering the greenback. However, Admitted objective: to restore tone to American exports to Japan. Therefore, and increase imports from the world number from this same country. Because in your dollar our problem! fact, the agreement of the G5 was badly hiding a muscular show between the United States and Japan.

Japan in 1985 occupied the place of the world number 1 in the making. With its colossal commercial surplus vis-à-vis the United States. the country of the rising sun embodied absolute evil for Americans, a place that China took today.

In the Plaza. the central banks of the G5 therefore displayed a desire to lower the dollar vis-à-vis the Yen, by selling it massively on the foreign exchange market. Furthermore, The Japanese executed themselves without flinching. The substantial military protection offered by the United States to the Japanese is certainly for something.

“The endaka” is the Japanese term to designate the massive assessment of the yen between the agreement of the Plaza. that of the Louvre which marked the end of the interventions of the central banks at the end of 1987: between your dollar our problem! these 2 agreements, the Japanese currency won 35% vis-à-vis the dollar.

Has this concerted devaluation of the dollar borne fruit? No. Japanese exports have certainly dropped. but there followed a very strong recession in Japan in the early 1990s, certainly fed by the bursting of a bubble in real estate in the early 1990s. In fact, the Endaka fueled uncommon deflation in Japan, which is barely recovered.

Since the early 2000s, China has gradually taken the place of Japan.

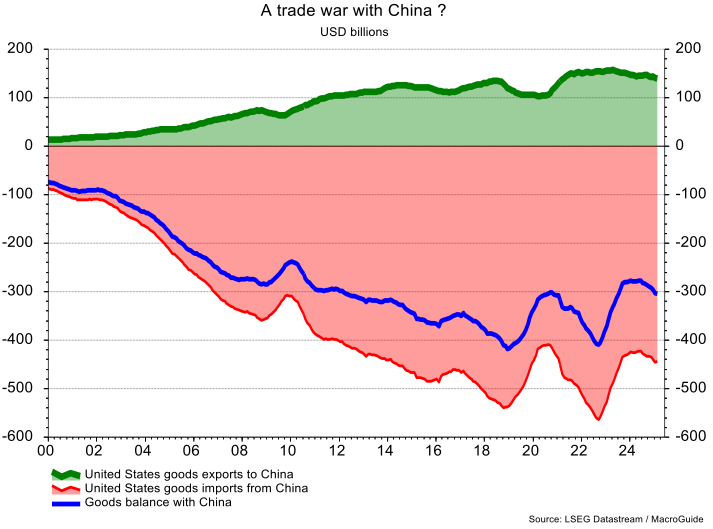

Our second graph is well shown: combined, American exports to China today reach 150 billion. American imports from the Middle Empire exceed 450 billion.

For Miran. the cause is heard: to eradicate their trade deficit of $ 300 billion, the Americans must impose on China the same diet that they have undergone in Japan 40 years ago.

China should reassess its currency to reduce the American deficit? We can forget your dollar our problem! it

The probability that the Chinese executes with the same humility as the Japanese?. It is – very – close to zero. The Chinese have seen the economic disaster that endaka caused in Japan. are not ready to run this same risk. Their economy is already well weakened by the same phenomenon that struck Japan in 1990: that of the bursting. of the real estate bubble. And the United States has nothing to offer to China as military protection, far from it.

A rereading of the Miran guide reveals that in fact. he would like the United States to play on 2 tables: that “to adjust the value of the greenback to reduce the inflationary impact of customs barriers and that of lowering it to reduce the trade deficit. To hide a blatant contradiction of those who would like to have butter. your dollar our problem! butter money, Miran uses the term “adjustment”, where it should use that of “appreciation”.

So, the dollar, higher or lower? It is this last option that the markets have chosen to follow since Trump listens to Miran. And to validate Connally’s vision. the decline in the dollar is a problem for countries -outside the United States of course -whose growth is based on exports. And there are many.

Except that this drop in the greenback is not the work of a concerted action between the central banks concerned. but the result of a loss of confidence which is always more generalized than the dollar can maintain its status of global reference currency. For the moment this status is maintained for lack of credible monetary alternatives. like the Borgne which is king in the land of the blind. But it could change one day.

* https://www.hudsonbaycapital.com/documents/fg/hudsonbay/research/638199_a_users_guide_to_restructuring_the_global_trading_system.pdf Guide to your dollar our problem! resolve commercial imbalances

Your dollar our problem!

Further reading: “A 6 -stroke engine, you read that right”: Porsche has just filed a patent that turns the thermal rules upside down – A site of Star Wars fans transformed into a secret headquarters: the CIA orchestresses exchanges with its spies under the guise of galactic passion – The Ministry of the Armed Forces confirmed the order of first six Air Dones VSR-700 for the Navy – The hypercar which reaches 275.74 km/h… in reverse – Swiss: Fall outside the top 10 of the best airlines.